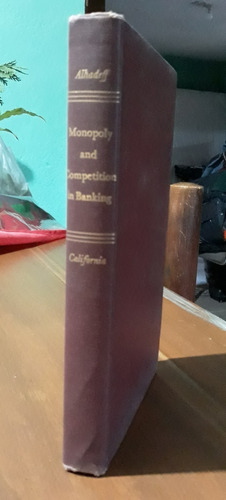

Monopoly And Competition In Banking

¡Última disponible!

2 ventas

2

Ventas concretadas

Brinda buena atención

Entrega sus productos a tiempo

Descripción

Here, for the first time, is a systematic analysis of the economic effects of concentration in banking.

The elimination of thousands of independent banks and the corresponding growth of giant banking institutions have raised fears that American free enterprise is being undermined by a growing monetary monopoly, Widespread failure to recognize the heterogeneity of banking markets has often resulted in over-simplified generalizations about monopoly and competition in banking. In this study, the autor upsets certain misconceptions by approaching banking from a market-structure point of view. This structural analysis gives special emphasis to the operations of the giant branch banks.

The study has two purposes: to develop a systematic theory of banking markets showing the major forces affecting them; and to analyze with actual statics the effects of concentration on the operation of banking markets.

The examination goes beyond the local market to include the influence of the open money market and of Federal Reserve actions and politices.

Using the operating ratios secured from individual branch banks, the author compares branch and unit bank performance on the basis of the statical record. He gives data for interest rates, costs, output, and profits.

The author supplies answers to two critical questions. What is the meaning and nature of monopoly as applied to banking? What are the consequences of power, actual or potential, in concentrated banking markets?

The book begins with the assertion that "the existence of concentration no more proves monopoly influence than does the mere existence of several thousand banks assure competition among them."

It ends with a careful appraisal of the economic consequences of concentration in California, where unit banks have been eliminated in large numbers and four branch banks have gained control of two thirds of the banking resources in the state.

The author is Assitant Professor of Business Administration at the University of California, Berkeley.

Preguntas y respuestas

¿Qué quieres saber?

Pregúntale al vendedor

Nadie ha hecho preguntas todavía.

¡Haz la primera!